Best Ways To Send Money From The UK To Pakistan

Are you one of those struggling to send money to your loved ones living across borders? Well, there’s no doubt in saying that remittances have become a pillar of life for millions of people living across Pakistan. People across the country are managing their expenses with the help of every penny transferred to them from their loved ones.

With each passing day, the advancement in technology has made fintech alliances grow enormously. Looking back, there were only a few options available to send and receive money in Pakistan. However, today, the payment and payout methods have evolved to a great extent. Several digital remittance providers have boomed the way Pakistanis receive their remittances.

Wondering what are the quickest ways to transfer money to Pakistan from the UK ? Let’s take a look!

Top Money Transfer Service Providers From the UK to Pakistan

When transferring money from the UK to Pakistan, several reliable service providers stand out. They are known for their efficiency, reliability, and user-friendly features. A few of these providers are:

- TangoPay: TangoPay has a user-friendly interface and competitive rates. It provides convenient transfers to Pakistan with varying delivery options. The good news is that the first three months with TangoPay are fee-free!

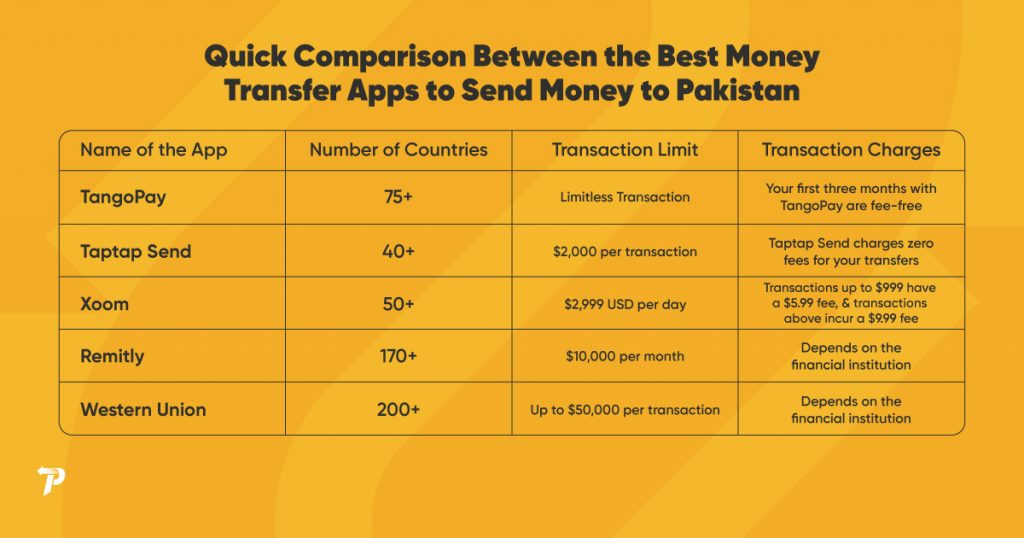

Comparison of Fees Among the Top Money Transfer Apps for Sending Money to Pakistan

<script type='text/javascript' src='//pl24898429.profitablecpmrate.com/8d/87/95/8d879591a5e1d56736cb3f672ef3c871.js'></script>

When comparing transfer fees among leading money transfer applications, it’s important to consider a few factors. These factors might affect the overall cost.

Exchange Rates:

Keep an eye on the exchange rates offered by these applications. Seemingly low exchange rates could be offset by less favourable exchange rates.

Transfer Fees:

Different applications have varying fee structures for sending money internationally. Some apps may charge you a flat fee, while others might use a percentage-based fee.

Promotions and Offers:

Some apps run promotions or offer discounts on fees, especially for first-time users – just like TangoPay! Your first three months with TangoPay are fee-free.

Additional Costs:

Be mindful of hidden costs. These may include intermediary bank fees or extra charges for specific payment methods.

Here’s a quick comparison between the rates offered by top money transfer apps for sending money to Pakistan.

Things To Consider When Sending Money Abroad

When sending money abroad, it is important to consider several key factors to ensure a smooth and cost-effective transfer. Understanding these elements can help streamline the process and make informed decisions.

Here are five key considerations to keep in mind:

Service Accessibility

Choose a service that both you and the recipient can easily access. Remember, some apps might not be available in certain countries. So, find one that fits your global needs.

Hidden Costs

Keep an eye open for hidden charges that could chip away at your transferred amount.

Customer Support

Opt for a service with reliable customer support. You never know when you might need assistance. So, having a prompt and helpful support can be a lifesaver.

Transactional Limits

You double-check all your documents before you set off on a new journey, right? Make sure you do it for your financial journey, too. Check for any transactional limits set by the service provider before you move your funds.

Reviews and Reputation

Take a moment to read reviews and consider the reputation of the service provider. It will provide you with valuable insights into the reliability and credibility of the service, ensuring a trustworthy and smooth transaction experience.

Cheap Ways to Send Money to Pakistan from the UK

When seeking affordable ways to transfer money from the UK to Pakistan, several options can help minimise fees and maximise value:

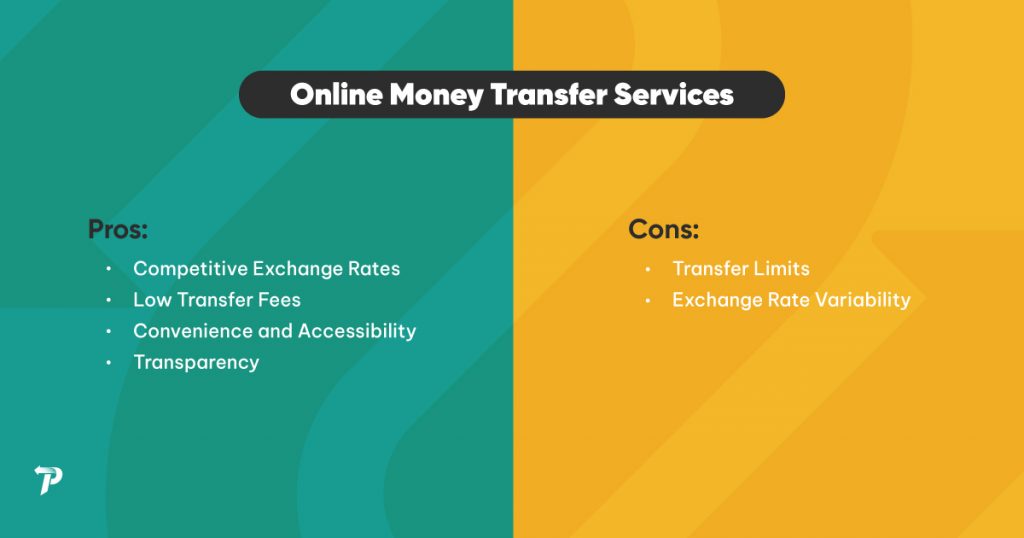

Online Money Transfer Services

Platforms like TangoPay, TapTap Send, Remitly, Xoom, ACE or WorldRemit offer competitive exchange rates and lower fees compared to traditional banks. This ensures that your money is transported to Pakistan from the UK – with no extra money charged!

Send Money Via TangoPay Now

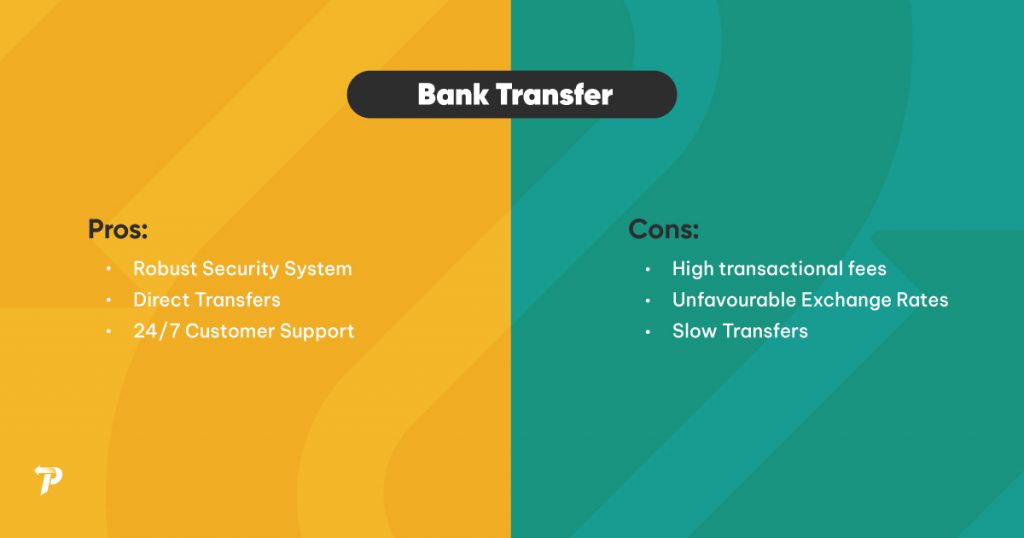

Bank Transfer

Some banks offer competitive rates for international transfers. Check with your bank to compare their fees and rates. The more you research, the more you tend to strike the best deal.

Peer-to-Peer Services

Consider peer-to-peer money transfer platforms like PayPal or Revolut. These options may offer reasonable rates and quick transfers, making your transactions – swifter!

Cryptocurrency Transfer

Using cryptocurrencies like Bitcoin for international transfers might be cost-effective. Though it requires both sender and receiver to have crypto wallets.

What is the Fastest Way to Send Money to Pakistan?

When urgency dictates the need for quick money transfers to Pakistan, several reliable money transfer apps step in. TangoPay, Send are leading platforms for fast international transfers.

TangoPay has a user-friendly interface and is committed to seamless transactions. It also prioritises expediency. The app’s streamlined processes aim to facilitate speedy transfers across the world. They ensure that funds reach recipients promptly and efficiently, catering to the time-sensitive nature of international remittances.

While these applications excel in expediting transfers, the actual speed can vary based on multiple factors. These factors include the transfer method chosen, payment options available, and the receiving bank’s processing times. It’s essential for senders to assess each app’s fees, exchange rates, and delivery options. This way, they can make an informed choice.

How Do You Get the Best Exchange Rate for Sending Money from the UK to Pakistan?

Getting your hands on the best exchange rate when sending money from the UK to Pakistan involves a few strategies. First, compare rates from different services. Look beyond the upfront fees to understand the actual cost, factoring in the exchange rate they offer.

Consider timing your transfer when the exchange rate is favourable. Keep an eye on the market trends to capitalise on better rates. Also, some services offer better rates for larger transfers. Bundling your transfers might be beneficial.

Also, explore if any promotions or special deals are available. Some platforms occasionally offer reduced fees or better rates. This applies to new users or certain transfer amounts. Always read the fine print to ensure there are no hidden charges.

Step-By-Step Guide to Transfer Money to Pakistan from the UK

Sending money from the UK to Pakistan involves directing through various options to ensure a smooth transfer process. Choosing the right platforms, understanding the steps involved and considering essential factors are important.

Here’s a comprehensive step-by-step guide to facilitate a seamless transfer to Pakistan from the UK.

Step 01 – Choose a Transfer Service

Do your research! Select a reliable money transfer service like TangoPay, Remitly, Xoom, or others that cater to transfers to Pakistan.

Step 02 – Sign Up and Verify Your Account

Create an account on the chosen platform. Complete the verification process by providing necessary identification documents as required by the service.

Step 03 – Enter Recipient Details

Enter the recipient’s information accurately. This information includes their full name, address, and account details such as bank name, account number, and SWIFT code.

Step 04 – Select Transfer Method

Choose the amount you wish to transfer. The next step is to choose a preferred transfer method. Be it a direct-to-bank, cash pickup, or mobile money – ensure that it causes no hassles for you.

Step 05 – Review Fees and Exchange Rates

Carefully review the fees charged by the service provider. Make sure you consider the exchange rate being offered. You should be comfortable with the overall cost of the transfer.

Step 06 – Initiate the Transfer

Initiate the transfer by confirming the details entered and authorising the transaction. Some services might require additional security measures like two-factor authentication.

Step 07 – Track the Transfer

After processing the transfer, track its progress through the service’s app. Some platforms provide real-time updates on the transfer status. Make sure to check them before making any decisions.

Step 09 – Keep Records

Keep records of the transaction, including transaction IDs, emails, and receipts for future reference.

Follow these steps to ensure a smooth and secure money transfer from the UK to Pakistan using your chosen money transfer service.

Conclusion

There’s no doubt in saying that money transfer apps are the cheapest way to move your funds from the UK to Pakistan. These service providers aren’t just safe but are well-regulated by the authorised mastery. Money transfer apps are a better choice than direct transfers. This is because they have lower transfer fees, no hidden charges, and quick delivery time.

However, comparing these money transfer apps is important to ensure you get the best deal. Make sure that you evaluate their exchange rates, fees, transfer speed, and reliability. Also, consider user reviews and any ongoing promotions that might affect the overall cost.

By making an informed comparison, you can select the service that aligns best with your needs, providing a smooth and cost-effective transfer experience. Good luck, transfer buddies!

Frequently Asked Questions

How long does a bank transfer to Pakistan take?

Ans. Bank transfers to Pakistan from the UK typically take 2-5 working days for the funds to reach the account. However, the exact duration can vary based on the bank’s processing times, weekends, and public holidays.

How to send money from the UK to Pakistan through a bank?

Ans. When sending money from the UK to Pakistan through a bank, follow a few simple steps. This will ensure a smooth and secure transfer process.

- Choose Your Bank: Select a bank offering international transfers to Pakistan.

- Provide Recipient Details: Input the recipient’s full name, bank name, account number, and IBAN/SWIFT code.

- Verify Fees and Rates: Check transfer fees and exchange rates offered by the bank.

- Authorise Transfer: Confirm details and authorise the transfer.

- Track Progress: Track transfer status online or through customer service.

Inform Recipient: Notify the recipient upon completion. Funds typically take 2 to 5 working days to reach their account.