What is Fintech Its Uses and Role in Online Payments

Introduction

Financial technology, or fintech, is the term used to describe how technology is being integrated into financial services to change how people and organizations handle transactions. Through peer-to-peer platforms, digital wallets, and smartphone applications, fintech has simplified online payment procedures, enabling quick, easy transactions without the delays associated with traditional banking. Additionally, it protects customers from fraud by enhancing security through biometric authentication and powerful encryption.

What is Fintech?

In the UK, Fintech has taken centre stage in conversations, symbolizing the convergence of financial services and technology. This innovation represents a transformative process where the traditional banking system undergoes a digital metamorphosis, becoming more streamlined and adaptable. The roots of Fintech can be traced back to the late 2000s, during the financial crisis of 2008, which highlighted the need for a revised banking model.

This gap led to the emergence of Fintech, evolving from early players like PayPal to a wide array of apps and platforms today. Fintech has transformed financial transactions, making them simpler and more customer-friendly. Think of it as the Netflix of the financial world constantly updated, personalized, and incredibly convenient.

How Does Fintech Work?

Fintech simplifies financial services, making them accessible without the hassle of long queues or excessive paperwork. It leverages technologies such as cloud computing, blockchain, artificial intelligence (AI), and machine learning (ML) to deliver seamless and secure solutions.

Whether you’re transferring money internationally, making investments, or managing everyday transactions, fintech enables you to perform these tasks conveniently through your smartphone or computer. This integration of advanced technology enhances efficiency and security, transforming the way we handle our finances.

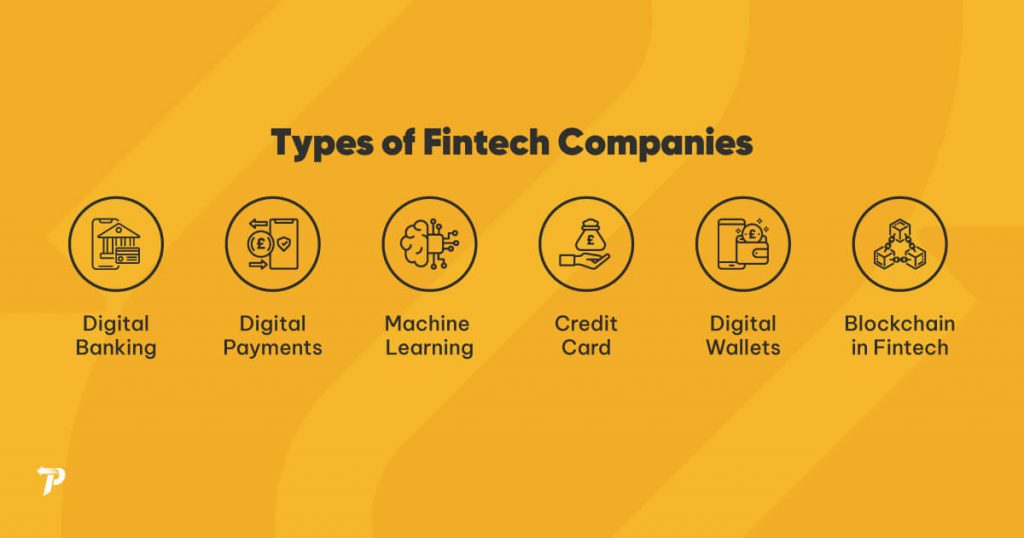

Different Types of Fintech Companies

Digital Banking

Digital banking means no annoying visits to banks and waiting in lines. These banks are fully digitalised, offering all the services you’d expect savings accounts, loans, and more right from your smartphone.

Digital Payments

If you’re an expat, the odds are that you’ve sent money back home. Digital payment platforms have made this a piece of cake. All it takes is a few taps on your screen, and voila, your money is winging its way across borders.

Machine Learning and Trading

If you’re into investments, machine learning algorithms can help you make sense of the convoluted world of stocks and bonds. These intelligent systems analyze vast amounts of data to give you investment advice that even Warren Buffett would nod at approvingly.

Fintech Lenders

Traditional banks might make you jump through hoops to get a loan, but Fintech lenders are changing that narrative. They use data analytics to assess your credit risk in a jiffy and offer loans that are often more flexible than those of traditional banks.

Digital Wallets

Physical wallets are so 2000-and-late. Digital wallets, where you can store everything from your credit card information to digital currency, are becoming the norm. They’re convenient and secure.

Blockchain in Fintech

Different from what is believed, blockchain isn’t just for crypto enthusiasts. This financial technology provides an extra layer of security to your transactions, making it nearly impossible for fraudsters to mess with your money.

AI and ML are the dynamic duo of Fintech. They analyze complex data to spot fraud, automate trading, and even customize financial advice based on your behavior and needs.

Benefits of Fintech

Fintech is revolutionizing the financial world, making it easier for everyone to manage their finances. Here are some key benefits that highlight how fintech technology facilitates hassle-free online payments:

Speed and Convenience

With fintech platforms, you can perform transactions, check your balance, and even apply for loans from anywhere at any time, eliminating the need for long bank queues. This convenience extends to online payments, allowing you to transfer funds instantly with just a few clicks.

Greater Choice

Fintech firms offer a wide range of options for online payments, whether you need to make domestic transfers, international remittances, or payments for goods and services. There’s a fintech solution tailored for your specific needs, ensuring you can choose the best option available.

Cheaper Deals

Fintech companies often operate with lower overhead costs, leading to reduced fees for users. This is especially beneficial for online payments, as it means you can send money or make transactions without worrying about high service charges eating into your funds.

Enhanced Security

Fintech technologies prioritize security, utilizing advanced encryption and fraud detection measures to protect your online payments. This added layer of security gives you peace of mind when conducting transactions, knowing your financial information is safeguarded.

More Personalized Products

With AI and data analytics, fintech services can offer personalized recommendations for online payment solutions that align with your habits and preferences. This ensures a tailored experience, making it easier to manage your finances effectively.

Fintech is not just reshaping the financial landscape; it’s providing numerous benefits that streamline online payments. Whether you’re a busy professional or someone looking for a more efficient way to manage money, fintech solutions are designed to meet your financial needs, making transactions hassle-free and secure. Explore these innovations further to see how they can enhance your financial management experience.

Fintech Risks

As the saying goes, “There’s no such thing as a free lunch.” While fintech is transforming how we interact with money, it comes with its own set of challenges and risks.

Unclear Rights

When dealing with traditional banks, consumer rights and protections are well-established. However, in the fintech space, these rights can become blurred. If a dispute arises, your rights may not be as clear-cut, complicating the resolution process.

Making a Rash Decision

The convenience that fintech platforms offer can sometimes backfire. Users may impulsively invest in volatile stocks because trading apps make it seem easy or transfer money without double-checking details. This user-friendly design can lead to hasty financial decisions.

Technology-based Risks

While fintech platforms employ the latest security measures, they are not entirely immune to risks such as hacking or data breaches. Anything online is susceptible to cyber-attacks, putting user data and transactions at risk. Generally, fintech companies invest heavily in security protocols to protect your data and financial transactions. However, as with any online service, a certain level of risk is always involved.

Financial Exclusion

Despite fintech’s mission to democratize finance, there is a risk of leaving behind those who are not technologically savvy. Not everyone has access to smartphones or the skills to navigate apps, leading to a form of financial exclusion for certain demographics.

Understanding these risks and the importance of choosing reputable fintech services that are transparent about their security measures is essential for navigating the fintech landscape effectively.

Is Fintech Safe?

This is the million-dollar question. By and large, Fintech companies invest heavily in security protocols to protect your data and financial transactions. However, as with anything online, there is always a certain level of risk involved. The key is to use Fintech services that are reputable and transparent about their security measures.

Role of Fintech in Online Payments

Fintech has revolutionized the landscape of online payments, making transactions faster, more secure, and more convenient than ever before. Here are some key roles fintech plays.

Enhanced Convenience

Fintech platforms allow users to make online payments anytime, anywhere, eliminating the need for traditional banking hours. Whether you’re shopping online or paying bills, fintech solutions enable quick and easy transactions at your fingertips.

Speed of Transactions

With fintech, online payments are processed in real-time, reducing the waiting time that often accompanies traditional banking methods. This immediacy is particularly beneficial for businesses and consumers who rely on fast transactions for efficiency.

Security Measures

Fintech companies prioritize security through advanced encryption and fraud detection technologies. This ensures that online payments are protected against unauthorized access and cyber threats, giving users peace of mind when conducting transactions.

Accessibility of International Money Transfers

Fintech has significantly simplified international money transfers. Traditional methods often involve high fees and long processing times, but fintech solutions offer competitive rates and instant transfers. This accessibility allows individuals and businesses to send and receive money across borders with ease.

Conclusion

From streamlining international money transfers to democratizing financial planning, fintech is unarguably the game-changer of our era. But, as with any technological innovation, it comes with its own set of challenges and risks. Whether you’re a die-hard tech enthusiast or just someone who wants to manage money without the hassles of traditional banking, fintech has something to offer you. The future is digital, and in the realm of finance, fintech is the star player.

To experience seamless and secure international money transfers, consider using TangoPay. With user-friendly features and strong security measures, TangoPay can help you stay financially connected wherever you are. Explore the benefits today!

FAQ’s

What is Fintech?

Fintech, short for “financial technology,” refers to the use of technology to offer financial services. It encompasses a wide range of services, from online banking and payment apps to investment platforms and beyond.

Is TangoPay Fintech?

Absolutely! TangoPay is a stellar example of a Fintech company. It specializes in remittance services, allowing users to transfer money from the UK to over 70 countries easily and securely. With its user-friendly mobile app, TangoPay is making financial transactions a breeze for expats in the UK.

What is the Difference Between FinTech and Banks?

While both offer financial services, traditional banks usually have physical branches and offer a wide range of services. FinTechs, on the other hand, operate online and often focus on specialized services like remittance, trading, or personal finance management.

Will Fintech Replace Banks?

Unlikely. Though Fintech is transforming the financial landscape, there’s still a role for traditional banks, especially for services that require a more personalized touch or extensive financial expertise.

How to Get Into Fintech?

If you’re interested in diving into the world of Fintech, there are several paths to take. You could start by becoming a user to get a feel for the services that interest you.