Roshan Digital Account: How Important Is It for Pakistanis?

Introduction

There are around 11 million Pakistanis who are employed in industrialized nations in order to receive financial support for their family. As a member of the millions of people who live in other countries, it is very likely that you have provided financial assistance by way of banks and money transfer services. Through a Roshan Digital Account in Pakistan, it is possible to send money to Pakistan from other regions of the world that are located in other countries.

What Is a Roshan Digital Account?

The Roshan Digital Account (RDA) is a banking solution designed for millions of non-resident Pakistanis (NRPs) and is an initiative of the State Bank of Pakistan (SBP). This account facilitates the smooth, convenient flow of remittances into Pakistan.

Beyond remittances, the RDA account allows you to bank, pay, and invest in Pakistan from anywhere in the world. You can open an RDA in Pakistani rupees or foreign currencies such as the US dollar, euro, and British pound, making it easy to send money to Pakistan from the UK, Europe, and the US.

Eligibility Criteria

Aside from NRPs, the eligibility for opening an RDA includes foreign nationals with a Pakistan Origin Card, federal or provincial government employees posted abroad in the tax year, and individual Pakistanis with declared assets abroad.

Funding

You can open your Roshan Digital Account with various commercial banks operating in Pakistan, including Standard Chartered, The Bank of Punjab, Dubai Islamic Bank, Allied Bank, and United Bank Limited, among others.

With the benefits of the Roshan Digital Account, such as easy remittance flow, investment opportunities, and the ability to bank internationally, it serves as an essential tool for overseas Pakistanis looking to maintain financial ties with their home country. Whether you’re considering which bank is best for the Roshan Digital Account or exploring the Roshan Digital Pakistan benefits, this account is customized to meet the needs of expats and their families.

Types of Accounts

The type of account you can open varies by bank. Some institutions offer options for single or joint accounts, as well as current or savings accounts. Additionally, all banks provide both conventional and Islamic Shariah-compliant account options. Be sure to check with your chosen bank to find the best fit for your needs.

Currency Options

The Roshan Digital Account (RDA) can be held in Pakistani Rupees, as an NRP Rupee Value account, or in select foreign currencies offered by the bank. Foreign Currency Value Accounts (FCVA) are typically available in US dollars, British pounds, or euros, although specific offerings may differ by bank. Some banks also provide additional currency options, such as Japanese Yen, Saudi Riyal, or Emirati Dirham. Keep in mind that fees associated with the RDA may vary depending on the currency in which the account is held.

Managing Your RDA Account

With an RDA account, you can easily apply, open, select investments, and manage your funds online. Most banks offer online banking or mobile app access for account management, allowing for convenient transactions and oversight. Choose a bank that offers the features and ease of use that best suit your requirements.

What Fees Can You Expect With Your RDA?

When depositing money to your RDA from abroad, expect a transfer fee. Although RDA banks have decided not to charge account holders for incoming or outgoing fund transfers, the foreign bank you’re using will impose a charge. Bank charges will vary.

Fortunately, RDA banks have made special arrangements with certain banks, like JP Morgan, Citi Bank, Standard Chartered and Deutsche Bank, to cut transfer charges to $5 – $9. However, you must secure the bank identification code (BIC) from the RDA bank to benefit from lower transfer charges.

Another fee to expect is the exchange rate. Foreign banks will take a cut of every pound or dollar they convert. UK banks, for instance, usually mark up exchange rates by 3% to 6%.

Benefits of a Roshan Digital Account

Eligible Pakistanis can go online to open an RDA with a partner bank. You fill out a digital form, choose your account type (foreign currency value account or rupee value account) and save the form if you don’t have some of the required details. You can return to where you left off and complete the form then.

You don’t need to visit any bank branch, so you complete the process remotely. The convenience of opening an account is a key benefit of the Roshan Digital Account.

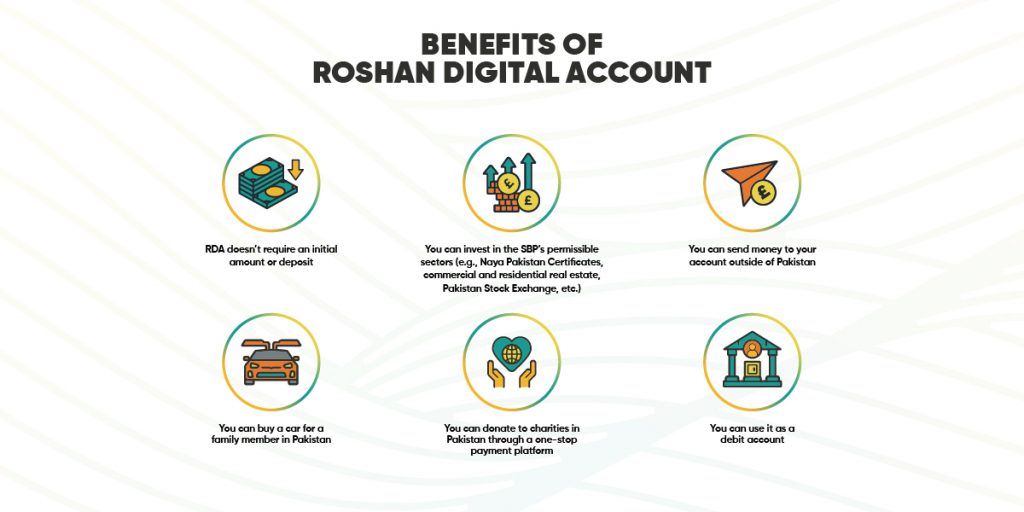

Other important benefits include:

- RDA doesn’t require an initial amount or deposit

- You can invest in the SBP’s permissible sectors (e.g., Naya Pakistan Certificates, commercial and residential real estate, Pakistan Stock Exchange, etc.)

- You can send money to your account outside of Pakistan

- You can buy a car for a family member in Pakistan

- You can donate to charities in Pakistan through a one-stop payment platform

- You can use it as a debit account

- When you’re in Pakistan, you can withdraw money from your account through an ATM or via cheques.

Although you can do Internet banking and different transactions with your RDA, certain limitations leave some NRPs with doubts about opening an account.

What Issues Can Arise From an RDA?

Roshan Digital Account is a good initiative in Pakistan, but some NRPs have encountered issues. The online form, to begin with, can be detailed, much like it would be when opening an account in a bank’s branch. Some overseas Pakistanis trying to open a bank account have taken a couple of days to complete the online form, diminishing an RDA’s convenience.

The detailed form is one of many issues. Some NRPs waited 10 days to get a provisional account. The standard period for processing is two days.

Another concern has to do with getting support during the application process. Because the partner bank is in Pakistan, their support teams follow local work hours. Many of their customers are in different time zones, so confirmation or clarification can occur at odd hours for NRPs.

Although the State Bank of Pakistan developed RDA as a tool to attract investments in Pakistan, many overseas Pakistanis use it to send remittances. After all, the existing infrastructure of the banking institutions means your family is sure to receive the money you send them. But confidence and understanding of RDA will take time to build up as a few issues get in the way.

How to deposit money in a Roshan Digital Account?

Depositing money into your Roshan Digital Account (RDA) is easy. Here are the common methods to fund your account:

- International Wire Transfer: You can transfer funds from your international bank account directly to your RDA using wire transfer services. Ensure you have your account details and any required bank codes to facilitate the transfer.

- Online Banking: If your bank offers online banking services, you may be able to deposit money into your RDA through their platform. This usually involves logging into your bank account, selecting the option to transfer funds, and entering your RDA details.

- Mobile Banking Apps: Many banks have mobile banking applications that allow you to make deposits easily. Download the app, log in, and follow the instructions to transfer funds to your RDA.

- Local Remittance Services: You can also use local remittance services that partner with banks in Pakistan. These services can facilitate deposits into your RDA from various countries.

- Currency Exchange Services: If you’re looking to convert foreign currency into Pakistani Rupees for your RDA, currency exchange services can assist with this, enabling you to deposit the converted funds into your account.

Before proceeding with any method, check with your bank for specific procedures, fees, and requirements to ensure a smooth deposit process.

Final Thought: Deposit Money in RDA using TangoPay.

For Pakistanis living abroad and others who wish to maintain connection to their homeland, the Roshan Digital Account (RDA) is an excellent financial choice. It makes sending money home simple by enabling you to manage your finances online, invest, and keep money in many currencies. Whether you’re investing in possibilities or providing for your family, the RDA’s practical features let you remain active in your nation’s economy.

You may maximize the benefits of your Roshan Digital Account and streamline your financial life by selecting the appropriate bank and utilizing the services offered. TangoPay makes it easy, safe, and quick to send money to Pakistan in a number of different currencies. Our goal is to make sending money to loved ones as simple and flexible as possible.

Frequently Asked Questions

Which Pakistani Bank is Best for a Roshan Digital Account?

Choosing the best bank for a Roshan Digital Account (RDA) depends on your specific needs and preferences. Some of the popular banks offering RDAs include Standard Chartered, Dubai Islamic Bank, and United Bank Limited. These banks are known for their strong online banking platforms, customer service, and competitive features. It’s a good idea to compare the offerings of different banks, considering factors like fees, customer support, and available currency options

Is Roshan Digital Account Taxable in Pakistan?

Funds in a Roshan Digital Account are generally not subject to tax in Pakistan, as the account is designed for non-resident Pakistanis (NRPs). However, any income generated from investments within the account, such as interest or dividends, may be subject to taxation. It’s advisable to consult a tax professional for specific guidance based on your situation.

Which Pakistani Bank Allows International Transactions?

Most banks offering Roshan Digital Accounts, such as Standard Chartered, Allied Bank, and United Bank Limited, allow for international transactions. These banks have established processes for managing foreign currency and facilitating remittances, making it easier to send and receive money from abroad.

How to Send Money to Pakistan from Abroad

To send money to Pakistan from abroad, you can use various methods, including:

- Bank Transfers: Use international wire transfers through your bank.

- Remittance Services: Services like Western Union or MoneyGram allow you to send money quickly.

- Online Transfer Services: Platforms such as TangoPay enable easy and fast international money transfers directly to bank accounts, including RDA accounts.

Can I Send Money to RDA from Abroad?

Yes, you can send money to your Roshan Digital Account from abroad. The account is specifically designed to facilitate remittances and international transactions. You can use wire transfers, online banking, or services like TangoPay to deposit funds into your RDA, ensuring a smooth transfer process to support your financial needs in Pakistan.