Understanding the Pros and Cons of Money Transfer to Pakistan

Money transfer is an essential cog in the wheel of modern finance. It’s the process of moving funds from one person or entity to another, crossing geographical, economic, and technological borders. In today’s interconnected world, money transfer powers businesses, supports families, and connects economies.

Whether it’s a migrant worker sending earnings home, a parent funding a child’s education abroad, or a business paying for international services, money transfers play a pivotal role. They bridge distances, fuel economies, and foster global relationships.

Money transfers are not just transactions; they’re lifelines that bind the global village together.

Challenges in Money Transfer to Pakistan

Transferring money to Pakistan can come with several challenges that users need to be aware of:

High Transaction Fees:

Many money transfer services charge high fees, which can reduce the overall amount received by the recipient. Users may find it challenging to identify services that offer competitive pricing.

Exchange Rate Fluctuations:

Currency exchange rates can vary widely between different providers, leading to unexpected losses. Users must continuously monitor rates to ensure they’re getting a fair deal.

Processing Delays:

Transfers can sometimes take longer than expected, particularly with traditional banks. Delays can create inconvenience, especially if the funds are needed urgently.

Fraud and Security Risks:

The risk of fraud is a concern in any financial transaction. Users must be vigilant about choosing reputable services and safeguarding their personal information.

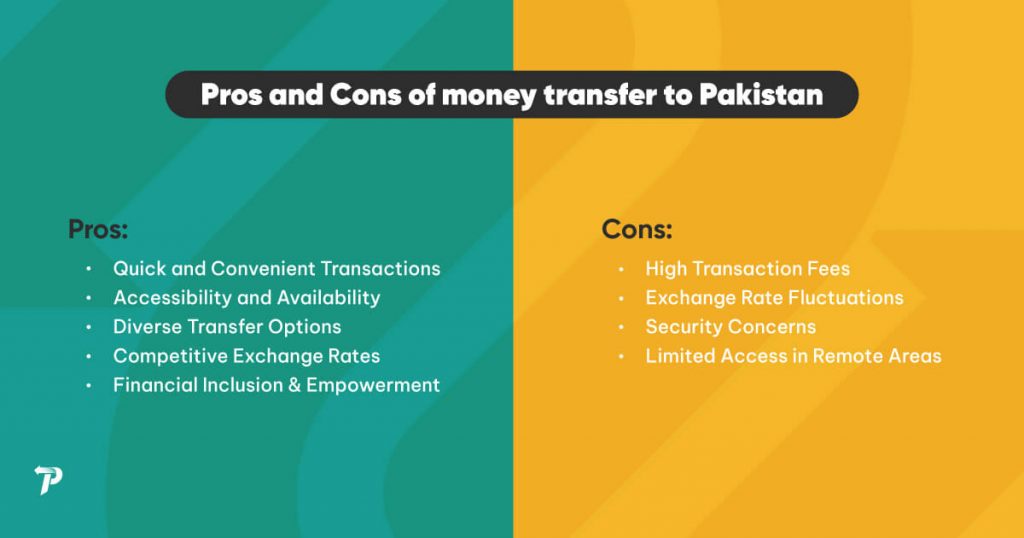

Pros and Cons of Money Transfers to Pakistan

Pros of Money Transfer to Pakistan

When choosing a money transfer service for sending funds to Pakistan, it’s important to consider several factors to ensure your transaction is successful and meets your specific needs. Here are some key pros to consider:

Quick and Convenient Transactions

- Efficiency: Reliable services prioritize fast transactions, ensuring that funds reach the recipient promptly. This is particularly crucial in urgent situations where time is of the essence.

- User-Friendly Platforms: Services that feature easy-to-understand interfaces, both online and on mobile apps, enhance the overall user experience, making it simpler for users to complete their transfers without frustration.

Accessibility and Availability

- Wide Reach: Choose a service with a broad network in Pakistan to ensure your recipient can easily access the funds, regardless of their location. A widespread network enhances the convenience of the transaction.

- 24/7 Service: Money transfer services that operate around the clock accommodate different time zones and urgent transfer needs, providing flexibility for users in various regions.

Diverse Transfer Options

- Flexibility: Services that offer multiple transfer methods, such as bank transfers, cash pickups, and mobile wallets, cater to diverse user needs. This flexibility allows senders to choose the method that works best for them and their recipients.

- Customization: Tailoring the transfer method to suit the preferences of both the sender and recipient can significantly enhance the overall experience.

Competitive Exchange Rates

- Maximizing Value: Services with competitive exchange rates ensure that your recipient receives more value in the local currency, making your transfer more effective.

- Cost-Effectiveness: Comparing exchange rates among different services helps users secure the best deal, maximizing the amount transferred.

Financial Inclusion and Empowerment

- Supporting Unbanked Populations: Opting for a service that reaches recipients without traditional banking access promotes financial inclusion, enabling more individuals to participate in the economy.

- Economic Impact: Money transfers can contribute significantly to the local economy, empowering individuals and communities financially and improving their quality of life.

Cons of Money Transfer to Pakistan

While there are many advantages to using money transfer services, it’s also important to consider potential drawbacks or limitations:

High Transaction Fees

- Cost Burden: Some services impose high fees for international transfers, which can substantially reduce the amount the recipient actually receives.

- Varied Fee Structures: Different services have diverse fee structures based on factors such as transfer amount, method, and speed. This complexity can lead to confusion and unintentional costs.

Exchange Rate Fluctuations

- Unpredictability: Exchange rates can change rapidly, impacting the value of the money sent. This is especially challenging for individuals making regular remittances.

- Potential Financial Loss: If the timing of the transfer doesn’t align favorably with exchange rates, it can lead to a lower value received in the local currency.

Security Concerns

- Risk of Fraud: Online financial transactions are vulnerable to scams and fraudulent activities. Users must be vigilant in selecting reputable services.

- Data Privacy: Concerns about the security of personal and financial information arise, particularly with less established services. Protecting sensitive data is crucial.

Limited Access in Remote Areas

- Inconvenience for Recipients: Recipients in remote or rural areas of Pakistan may struggle to access funds, as not all locations are served by cash pickup points or banking facilities.

- Dependency on Local Infrastructure: Limited internet access and a lack of financial infrastructure can hinder the efficient use of online or mobile-based money transfer services.

Understanding these pros and cons is essential for anyone considering money transfer services to Pakistan. It highlights the importance of selecting a reliable and efficient service that balances cost, convenience, security, and accessibility to ensure a smooth transaction experience.

Additional Consideration while choosing money transfer services

When choosing an international money transfer service, several important factors should be taken into account to ensure a smooth and secure transaction:

Security:

Ensure the service has robust security measures, such as encryption and multi-factor authentication, to protect your financial and personal information. This is crucial for safeguarding against fraud and identity theft.

Fees and Charges:

Be aware of any hidden fees or additional charges that may apply to your transfer. Understanding the complete fee structure will help you make an informed decision and avoid unexpected costs.

Customer Support:

Reliable customer service is essential for addressing any issues or queries you might have. Look for services that offer multiple support channels, such as phone, email, or live chat, and check their availability.

Reputation and Reliability:

Research the service’s track record and read customer reviews to check its reliability and quality of service. A well-established provider with positive feedback can give you confidence in your choice.

Transfer Speed:

Consider how long the transfer will take. Some services offer instant transfers, while others may take several days. Choose a service that meets your time-sensitive needs.

Transfer Limits:

Check for any limits on the amount you can send in a single transaction or within a certain period. Some services may have restrictions that could affect your transfer plans.

Currency Options:

Ensure the service supports the currency you wish to send and allows for conversions at favorable rates. This can be particularly important for regular remittances.

User Experience:

Evaluate the usability of the service’s platform. A user-friendly app or website can make the transfer process easier and more efficient, especially for first-time users.

While money transfers to Pakistan offer numerous benefits, considering these additional factors can help you select a service that meets your specific requirements and enhances your overall experience.

Best Method for transferring money to Pakistan

When transferring money to Pakistan, several effective methods are available:

Bank Transfers:

Traditional bank transfers are secure but can be slow and involve higher fees.

Money Transfer Services:

Companies like Western Union and MoneyGram offer quick access to funds with extensive networks but may charge varying fees.

Money Transfer Apps:

Apps such as PayPal, Remitly, and TangoPay provide user-friendly options with competitive rates. TangoPay, in particular, stands out for its seamless online banking capabilities, allowing for quick transfers directly to bank accounts or mobile wallets.

Postal Services:

While slower, postal services can facilitate money orders, though this method is less common today.

Cryptocurrency:

Sending cryptocurrency can be fast and secure, but requires both sender and recipient to understand digital wallets and market fluctuations.

Final Thoughts

Sending money to Pakistan can be easy if you know your options. Whether you choose bank transfers, money transfer services, or apps like TangoPay, understanding what’s available is important. Pay attention to fees, exchange rates, and how quickly the money arrives.

For a simple and reliable experience, TangoPay is your best choice. With great exchange rates, no hidden fees, and fast transactions, it’s easy to send money to Pakistan.

Ready to get started? Download the TangoPay app today and see how easy transferring money can be!

Frequently Asked Questions

What is the best way to transfer money to Pakistan?

The best way to transfer money to Pakistan is through apps like TangoPay, which offers competitive rates, low fees, and fast transactions.

Is it legal to transfer money from the UK to Pakistan?

Yes, it is legal to transfer money from the UK to Pakistan, as long as you comply with local laws and regulations.

What is the limit of outward remittance from the UK?

The limit for outward remittance from the UK can vary by service, but generally, there are no restrictions. However, you may need to provide documentation for larger amounts.

Can I send money to a friend in Pakistan?

Yes, you can send money to a friend in Pakistan using various money transfer services, including banks and apps like TangoPay.

How much is a wire transfer fee?

Wire transfer fees vary by bank or service, typically ranging from £10 to £40, depending on the amount and destination.